| Licence | Exploration Right reference 12/3/252, Transkei & Algoa blocks |

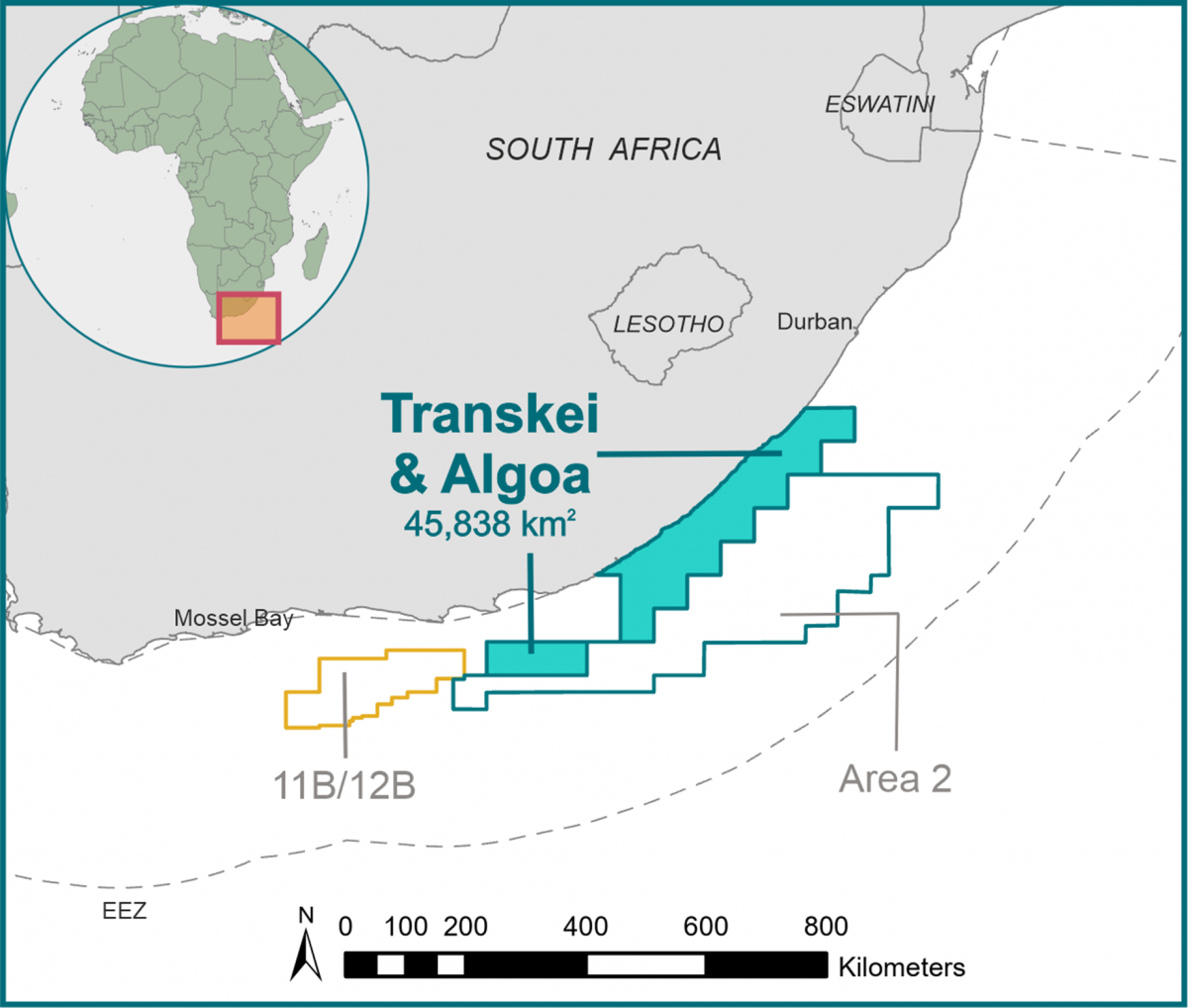

| Acreage | 45,839 km2 |

| Water Depth | Coastline to 3,000m |

| Impact Interest | 45% |

| Partners | BG International Limited, a wholly owned subsidiary of Royal Dutch Shell plc: 55% (Operator)*

*(subject to government consent) |

The Transkei & Algoa blocks form South African Exploration Right 12/3/252, located offshore eastern South Africa (Figure 1). The licence was initially awarded to Impact as a Technical Cooperation Permit in 2012, followed by an application for an Exploration Right, which was granted in 2014. The entire licence covers approximately 45,839km2 in water depths of up to 3,000 metres.

In 2020, Shell agreed to join the Transkei & Algoa licence, bringing with it substantial exploration expertise, but critically the technical and financial expertise to operate through development, in a success case.

In line with Impact’s strategy, the Transkei & Algoa areas offer multi-billion-barrel potential, partnered with a world class operator.

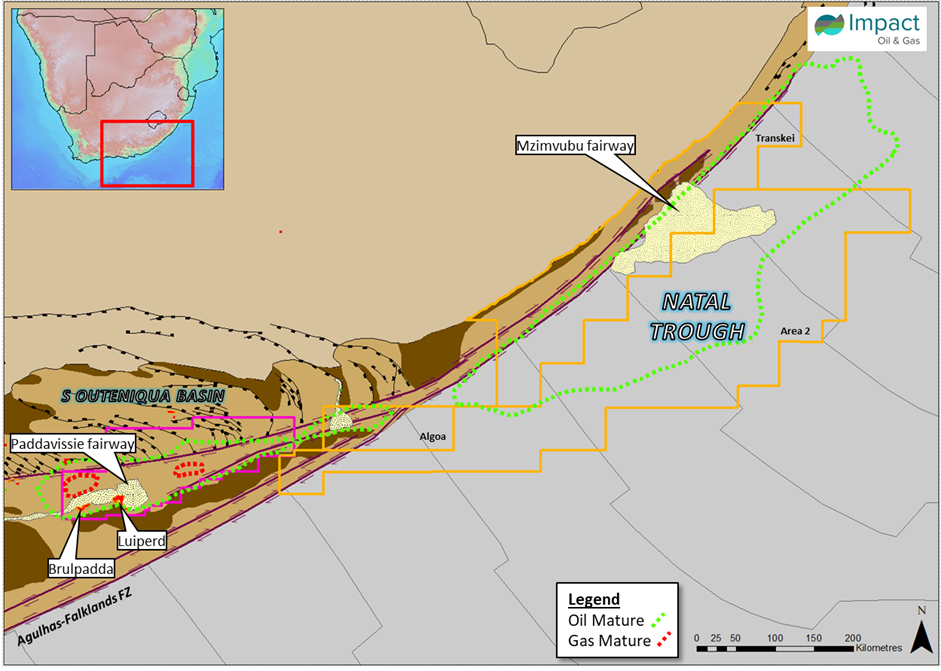

The Transkei & Algoa blocks, although awarded under the same licence, have different geological settings. The Algoa block is situated in the South Outeniqua Basin, a short distance east of Block 11B/12B, containing the world-class Brulpadda and Luiperd gas condensate discoveries.

The Transkei block sits off the Transkei Margin, in the Natal Trough Basin. The Natal Trough is an unexplored basin, which shares many of the geological fundamentals which have proven successful in the prolific Orange and South Outeniqua basins.

Figure 2 shows the structural setting of the Transkei & Algoa license, including the Albian sand fairways and area of maturity for the Lower Cretaceous source rocks.

The Transkei block spans approximately 500km along the Southern African coastline between Durban and East London and contains the world’s largest transform fault, the Agulhas-Falklands Fracture Zone (AFFZ) which divides the narrow continental shelf from oceanic crust of the Natal Trough (Figure 2).

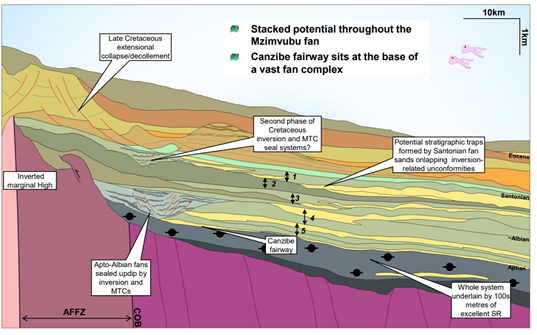

The Transkei blocks benefit from approximately 12,000km of 2D seismic data, acquired in 2013 and 2018. Using this data, the joint venture has identified highly material prospectivity associated with several large submarine fan bodies. The seismic data has indicated that a number of such highly material base of slope fan leads exist along the Transkei block. The feeder channels to most of these have been severed by a combination of faulting and erosion by fault-related debris deposits, thereby providing large secure stratigraphic traps.

The 2D PSDM dataset has also allowed the mapping of several gas chimneys, and amplitude conformance for at least one of the identified leads, providing compelling evidence of a working petroleum system.

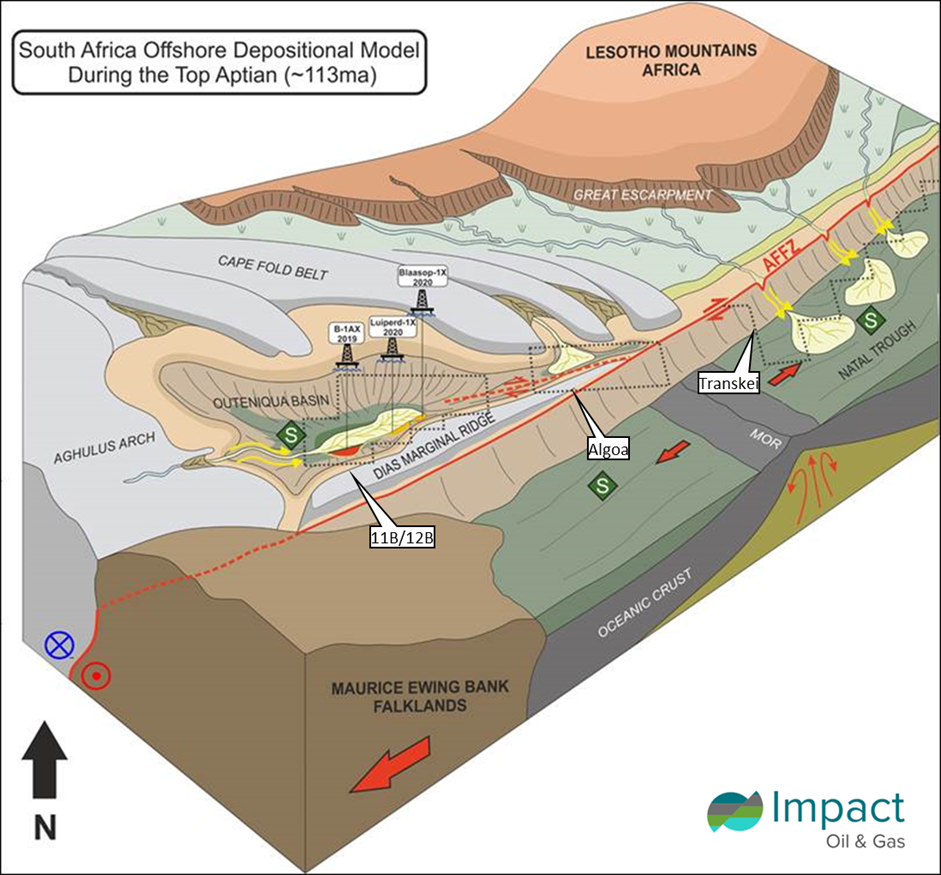

The Algoa block lies within the north-eastern part of the South Outeniqua basin. It bears similar play concepts to Block 11B/12B, operated by Total, which contains the Brulpadda and Luiperd gas condensate discoveries. These involve Lower Cretaceous basin floor fan sands pinching-out southwards against the inverted structural high of the Dias Marginal Ridge. Both the reservoir sands and the source rocks are of similar ages to those recognised in the Transkei and Algoa blocks which have also successfully been tested in the South Outeniqua Basin.

Figure 4 shows the configuration and depositional systems of the South Outeniqua basin relative to the Natal Trough during the late Aptian (approximately 113Mya). As illustrated, Impact’s Algoa license sits at the eastern end of the fairway proven by the Bulpadda and Luiperd gas condensate fields.

Seismic data on the Algoa block is limited with only sparse 2D data currently available. However, Algoa has demonstrated the presence of Lower Cretaceous fan sands. We believe that prospectivity in Algoa will be mainly within the oil window. The joint venture will continue its evaluation of the block and determine whether to proceed with a 3D seismic programme to mature the existing concepts and leads into drillable prospects.